Transferring Assets Across Subsidiaries

Transferring assets across subsidiaries requires valid asset transfer records. For more information, see Asset Transfer Accounts.

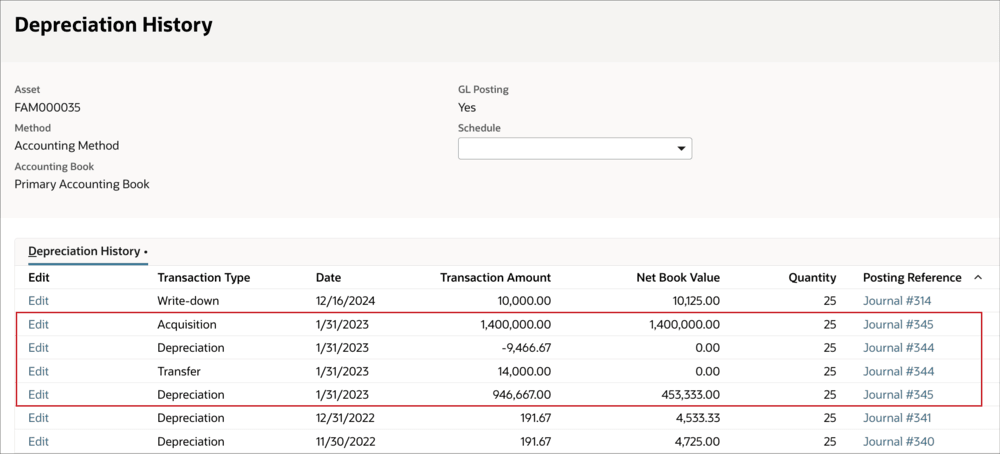

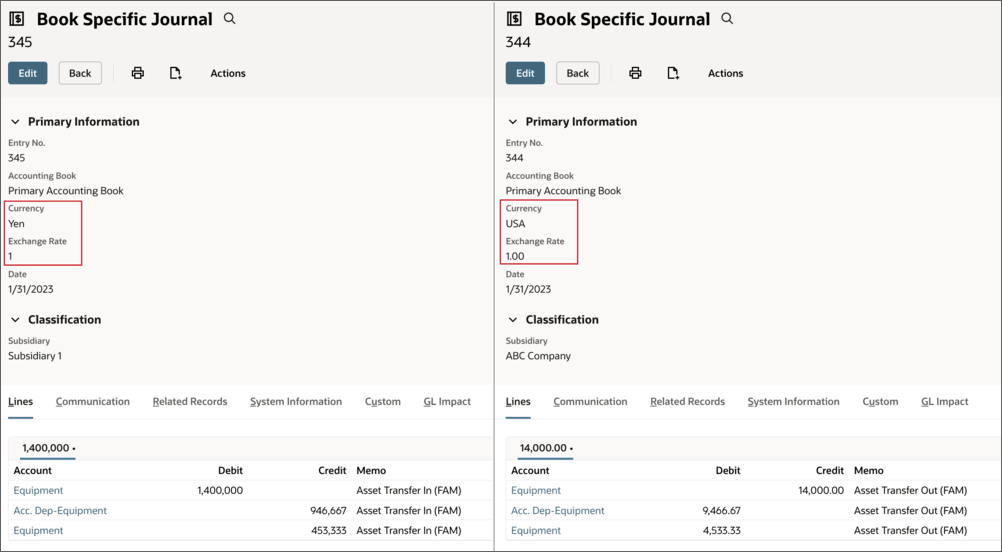

When you transfer an asset to another subsidiary, the system journals its current cost and accumulated depreciation from the origin subsidiary accounts to the destination subsidiary accounts.

During a transfer, the system automatically converts the asset value to the destination subsidiary's base currency. Depreciation journal entries and reports generated after the transfer reflect the new base currency. The system also converts the following values to the new base currency:

-

Asset Original Cost

-

Asset Current Cost

-

Residual Value

-

Current Net Book Value

-

Prior Net Book Value

-

Cumulative Depreciation

-

Last Depreciation Amount

The system tracks historical records of asset activities for both accounting and alternate/tax methods.