Customer Taxable Synchronization

Information about a customer's liability to taxation is now synchronized between NetSuite and NSPOS. Prior 2025.1.0 NSPOS release, this information was not synchronized into NSPOS.

The only way to make a customer tax exempt for all transactions, was to assign customer to tax exempted organization (See more at Making a Customer Tax Exempt For All Transactions ).

This option is still available in current release.

This feature only works with Legacy Tax. In SuiteTax, you cannot set a customer as non-taxable. You must assign the customer to a tax-exempted organization.

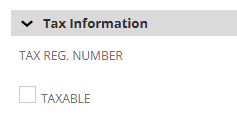

Using Legacy Tax in NetSuite allows the customer to be set as taxable or non-taxable by checking the Taxable box on the Financial sub-tab in the Tax Information section.

The PST Exempt field serves as the source of the taxability information if there is no Taxable box in NetSuite.

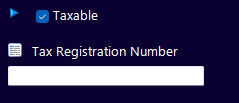

The taxable information and tax registration number are synced to NSPOS. Taxes are then calculated when the customer is within a NSPOS transaction.

New customers are taxable by default. All existing customers in the NSPOS system prior to 2025.1.0 are considered taxable unless a customer is part of a tax-exempted organization. In this case, the organization's tax certificate ID is set as the customer's tax registration number automatically.

Tax registration number does not need to be entered for non-taxable customers.

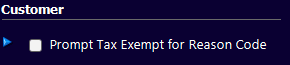

The prompt for tax exemption reason code can be used when a non-taxable customer is used within a NSPOS transaction.

This is configurable with new setting Prompt Tax Exempt for Reason Code in the Customer section in NSPOS.

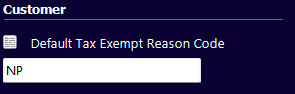

A default tax exempt reason code can be applied, instead of a prompt, by entering the correct reason code from the Tax Exempt reason group. For more information about reason code management, see Reason Codes. The reason code can be entered into the Default Tax Exempt Reason Code field.

Tax-exempted organizations need to be assigned to a customer for accurate tax exemption functionality in backward compatibility mode. New taxable information for a customer is not propagated to old workstations.